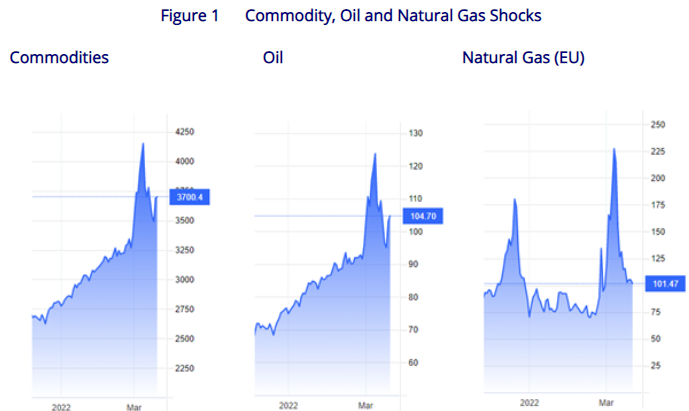

今天的财经新闻一大早就在讲欧美能源价格暴涨的问题,究其原因有很多,主要跟俄乌冲突相关,原文描述各种现象是这么说的:

The European and U.S. economies are suffering a backlash from the sanctions against Russia. Because of rising energy prices, the EU recorded a rare trade deficit, coupled with shrinking corporate profits and inflation-induced economic hardships. Businesses started to close or dial back operations in Russia in spite of years of market nurturing, ranging from automobiles to luxury consumer goods and daily necessities.

这段话翻译过来大致是:欧洲和美国经济正在遭受对俄罗斯制裁的强烈反弹。由于能源价格上涨,欧盟出现了罕见的贸易逆差,加上企业利润缩水和通货膨胀导致的经济困难。尽管市场经过多年的培育,从汽车到奢侈品和日用品,企业开始关闭或收回在俄罗斯的业务。其中涉及很多能源翻译以及金融翻译的专业词汇。

这里的backlash用得非常贴切,是反弹,有反过来遭受的后果的意思,另外record~~~trade deficit,coupled with的句型也非常工整以及简练。inflation-induced economic hardships这种句式也很值得我们学习,很多翻译喜欢把一句话说得清楚的事情拆成两句话,并且加很多because,of,however之类的词语,实则既不简练,也不清楚,用一个induced足以表明经济困境是由于通货膨胀引起的。

Worse, inflation has proved stickier than anticipated because the Federal Reserve began to cut rates belatedly in March 2020, ignoring the WHO's early warnings. The second mistake ensued after mid-year 2021, when inflation began to climb rapidly. As the Fed left the ultra-low rates intact, the galloping inflation soared to 7 percent in December, the fastest since 1982. America was coping with low interest rates and high inflation: stagflation。

这一段翻译非常难,因为belatedly一次非常让人困惑,很容易翻译成姗姗来迟的降息,其实真实意思是相反的,经常关注股市经济的的翻译会知道,2020年3月3日的降息让股市不升反降,因为这是决议之外的紧急降息,因此事实恰恰与字面意思相反。上因特普林翻译公司翻译为:第一个错误是由于美联储在2020年3月开始的紧急降息,无视世卫组织的早期警告。第二个错误发生在2021年年中,当时通货膨胀开始迅速上升。随着美联储保持超低利率不变,去年12月急剧上升的通货膨胀率飙升至7%,为1982年以来的最快水平。美国正在应对低利率和高通胀:滞胀,这里 stagflation是滞涨的准确表达,和通胀的区别很大。

综上所述,翻译不仅仅是一门技术活,更是对翻译时事知识,社会经验,经济逻辑的考量。